Online industry insight provider, IMRG, shares a comprehensive understanding of online retail furniture performance, covering three key areas, including online revenue, conversion rate and average basket value metrics.

The data presented throughout this article is from IMRG’s Online Retail Index, which tracks the online sales performance of 200 retailers across different product sectors in the UK.

Furniture Online Revenue Performance

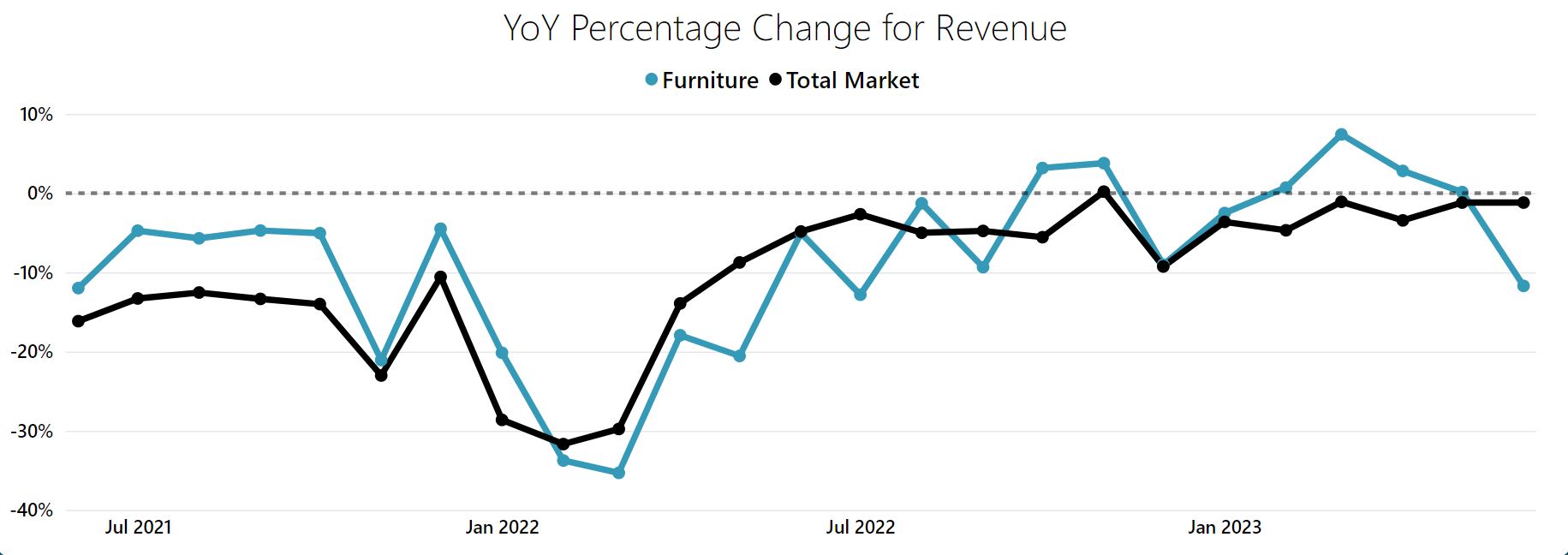

Chart A

Throughout the entirety of 2021, the online retail furniture category rode above the wave of total market Year-on-Year (YoY) revenue performance, albeit experiencing negative-territory growth from July onwards. However, as we entered 2022, the narrative changed, where for six months straight, the category was falling below the industry average, and stooped as low as -35.3% YoY in March that year.

The change was ignited by the move from lockdown, when many customers began making their homes more comfortable in preparation for many days indoors, to Covid-19 being considered as something of the past. Given that furniture items are often high ticketed, where customers had already heavily invested in items such as sofas, which are often once in every ten- or so-year purchases, retailers have had a challenging time achieving positive-territory growth ever since.

As you can see in Chart A, furniture experienced growth from February to May 2023. Though, IMRG’s Online Retail Index shows a considerable decline in revenue for furniture retailers in June 2023, at -11.7% relative to -5% in June 2022, marking the third year of negative-on-negative growth for this category.

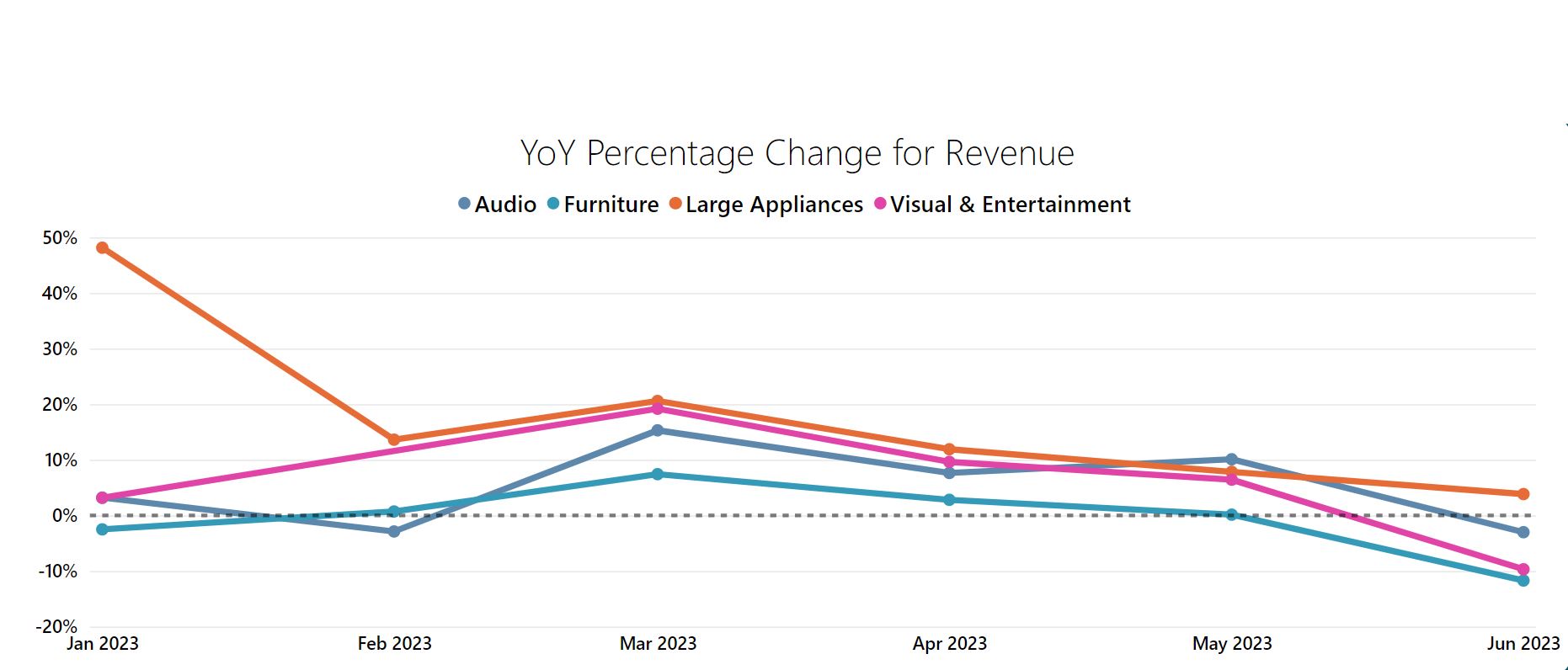

Chart B

Chart B shows 2023 data in isolation, featuring furniture as well as other high-ticket product categories, namely audio, large appliances, and visual & entertainment. From around April, retailers started to experience declines in revenue. These results largely owe to cost-of-living skews, where UK customers are dealing with high inflation and high mortgage rates.

With the intention of protecting their pockets, customers are looking towards cheaper product categories such as small appliances and health & beauty, which are subsequently having a slightly better time, despite trading in the same economic climate that is making growth more difficult.

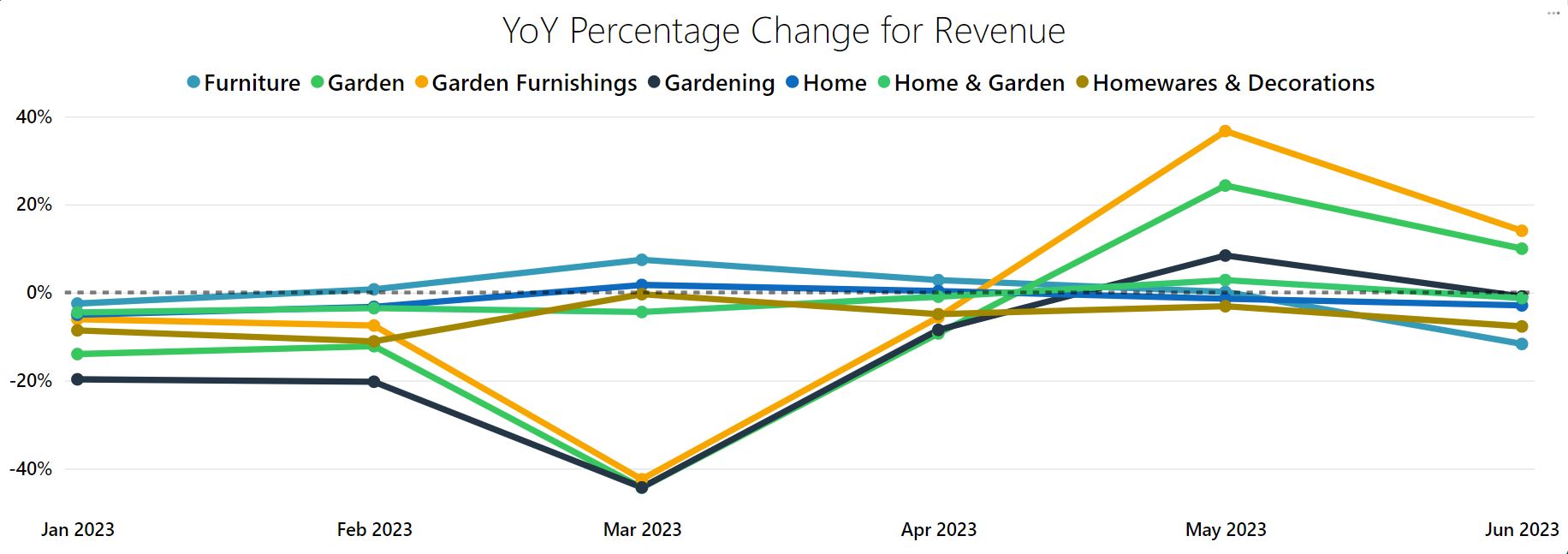

Chart C

Zoning in on the other subsections of the home & garden category, as presented in chart C, furniture performed relatively well throughout 2023 up until May when the other categories saw a significant peak and it experienced no growth. Again, this resonates with furniture’s price point, where customers are more inclined to enjoy May bank holiday deals that will not heavily dent their purses.

Sunnier days in the UK would also explain why categories such as garden would have an easier time converting customers, especially when many would have been having garden parties to celebrate three long weekends and King Charles III’s Coronation.

Furniture Online Conversion Rate Performance

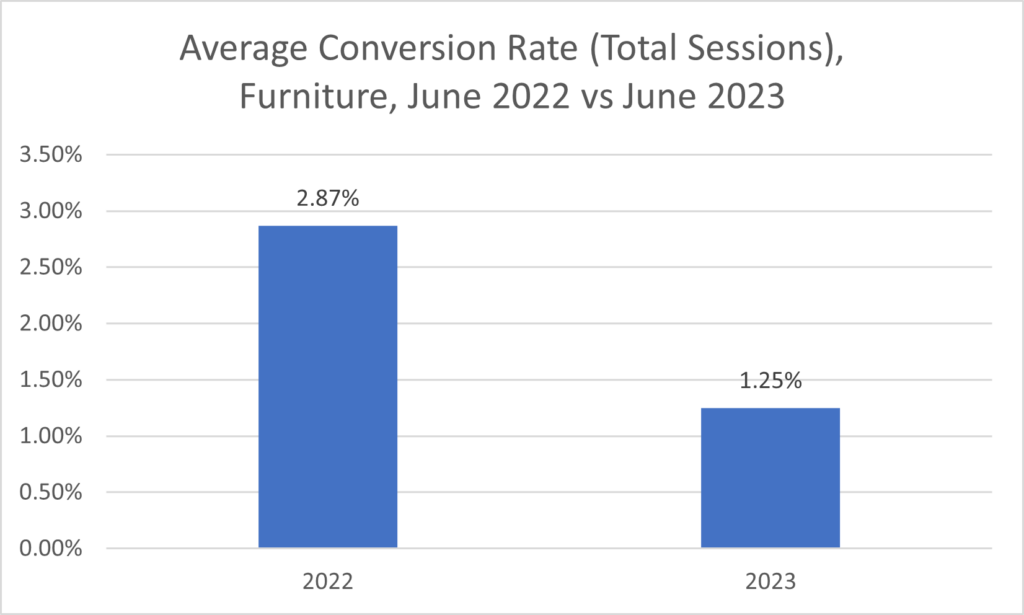

Chart D

Chart D reveals that conversion has been a pain-point for furniture retailers in 2023. The average conversion rate for total sessions was 2.87% in June 2022 and has fallen to 1.25% in June 2023, signalling a yearly 1.6 percentage point drop in conversion. The current rate is much lower than the total market, which achieved a conversion rate of 3.23% in June this year, mostly driven by health & beauty retailers.

This data reverberates the idea that customers were much more likely to purchase from a furniture retailer during Covid-19 than they are when their home bills and necessary items, such as food, are too high. Also, owing to the rising interest and mortgage rates, there will be fewer new home buyers, so less customers will be interested in buying furniture.

It is no wonder that traffic for furniture is down, experiencing lows such as -15.4% YoY. However, there are some promising signs from a Week-on-Week (WoW – How this week’s performance compares to the week previous) perspective. For the whole month of June, each week outperformed the last, where the final week in June was up +10.6%.

Looking at WoW for orders, the final week of June also saw growth, at +15.5%, implying that by August, furniture revenue could revert to positive-territory YoY growth.

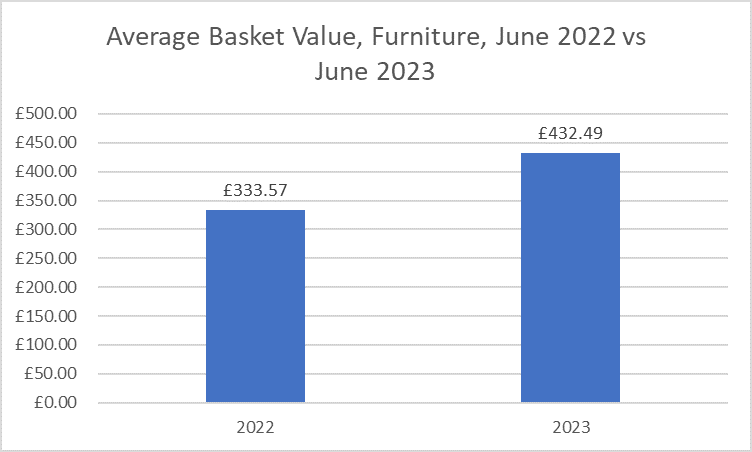

Furniture Online Average Basket Value Performance

Chart E

As shown in Chart E, the average basket value for furniture retailers has seen a substantial increase from 2022 to 2023. There are a number of reasons why this might be the case at a time when conversion rates are low, for example, the rising cost of acquisition, increased supply chain costs, inflation affecting buyers’ intent, all of which might cause retailers to deflect some of the cost onto their customers.

It could also mean that customers have switched their buying habits, such as opting for fewer, more quality items rather than multiple cheaper items that will unlikely stand the same test of time.